Woodworking Business Taxes . You can choose from different. Thankfully, there are several ways beginners can build a strong portfolio. registering your woodworking business is crucial for tax purposes and legal protection. This can be tricky if artisans have just started and don’t have anything to show them yet. learn how to plan, research and launch your own woodworking business with this comprehensive guide. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. build a professional portfolio. Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers. The first thing new clients will want to see is evidence that business owners do good work. obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. The online ein application streamlines this required process.

from bestwoodworkingideas.netlify.app

You can choose from different. obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. The first thing new clients will want to see is evidence that business owners do good work. build a professional portfolio. This can be tricky if artisans have just started and don’t have anything to show them yet. Thankfully, there are several ways beginners can build a strong portfolio. registering your woodworking business is crucial for tax purposes and legal protection. The online ein application streamlines this required process. learn how to plan, research and launch your own woodworking business with this comprehensive guide. Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers.

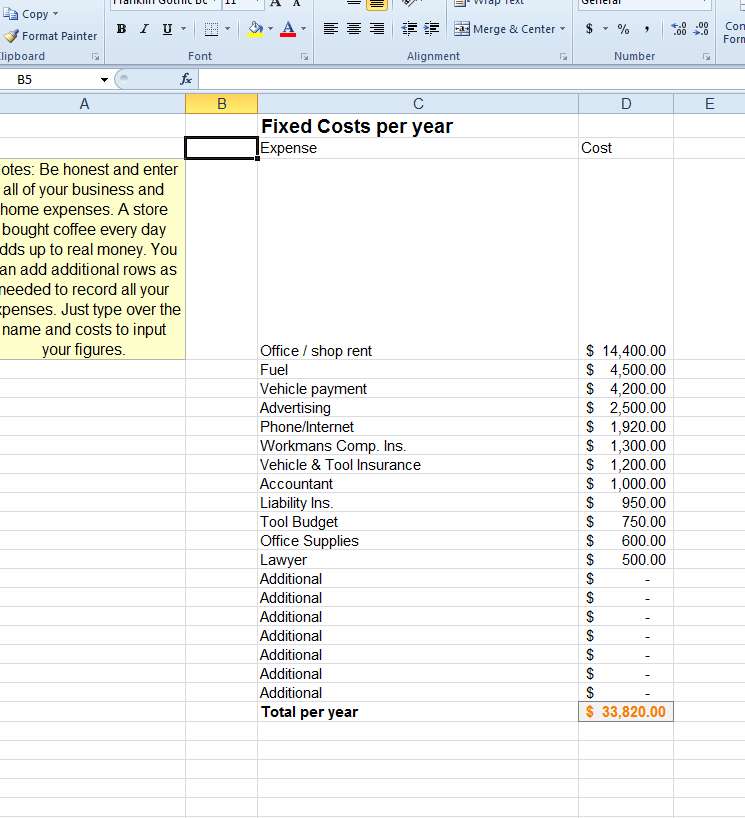

Business expenses woodworking

Woodworking Business Taxes build a professional portfolio. obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. learn how to plan, research and launch your own woodworking business with this comprehensive guide. The online ein application streamlines this required process. This can be tricky if artisans have just started and don’t have anything to show them yet. Thankfully, there are several ways beginners can build a strong portfolio. registering your woodworking business is crucial for tax purposes and legal protection. You can choose from different. The first thing new clients will want to see is evidence that business owners do good work. build a professional portfolio. Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers.

From www.scribd.com

Woodworking Business Plan Example PDF Gross Margin Value Added Tax Woodworking Business Taxes build a professional portfolio. Thankfully, there are several ways beginners can build a strong portfolio. registering your woodworking business is crucial for tax purposes and legal protection. obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. Find out what projects to make. Woodworking Business Taxes.

From www.nichepursuits.com

9 Profitable Woodworking Business Ideas to Try In 2024 Ultimate Guide! Woodworking Business Taxes registering your woodworking business is crucial for tax purposes and legal protection. Thankfully, there are several ways beginners can build a strong portfolio. learn how to plan, research and launch your own woodworking business with this comprehensive guide. Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and. Woodworking Business Taxes.

From www.slideshare.net

Woodworking business Woodworking Business Taxes The online ein application streamlines this required process. registering your woodworking business is crucial for tax purposes and legal protection. obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. Thankfully, there are several ways beginners can build a strong portfolio. build a. Woodworking Business Taxes.

From cesphstb.blob.core.windows.net

Woodcraft Employment at Ned blog Woodworking Business Taxes This can be tricky if artisans have just started and don’t have anything to show them yet. learn how to plan, research and launch your own woodworking business with this comprehensive guide. Thankfully, there are several ways beginners can build a strong portfolio. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends. Woodworking Business Taxes.

From www.slideteam.net

One Page Woodworking Business Plan Presentation Report Infographic PPT Woodworking Business Taxes setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. The first thing new clients will want to see is evidence that business owners do good work. build a professional portfolio. You can choose from different. The online ein application streamlines this required process. This can be tricky if artisans. Woodworking Business Taxes.

From www.youtube.com

How To Start A Woodworking Business + Projects And Plans YouTube Woodworking Business Taxes build a professional portfolio. obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. The online ein application streamlines this required process. registering your woodworking business is crucial for tax purposes and legal protection. This can be tricky if artisans have just started. Woodworking Business Taxes.

From assembleandearn.com

Start a Woodworking Business From Home Woodworking Business Taxes registering your woodworking business is crucial for tax purposes and legal protection. This can be tricky if artisans have just started and don’t have anything to show them yet. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. Thankfully, there are several ways beginners can build a strong portfolio.. Woodworking Business Taxes.

From www.template.net

10+ Carpenter Invoice Templates Free Sample, Example Format Download Woodworking Business Taxes Thankfully, there are several ways beginners can build a strong portfolio. This can be tricky if artisans have just started and don’t have anything to show them yet. build a professional portfolio. The first thing new clients will want to see is evidence that business owners do good work. You can choose from different. learn how to plan,. Woodworking Business Taxes.

From standingcloud.com

7 Steps to Kickstart Your Woodworking Business at Home StandingCloud Woodworking Business Taxes Thankfully, there are several ways beginners can build a strong portfolio. registering your woodworking business is crucial for tax purposes and legal protection. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. Find out what projects to make and sell, how to calculate costs and profits, and where to. Woodworking Business Taxes.

From bestwoodworkingideas.netlify.app

Business expenses woodworking Woodworking Business Taxes obtaining an ein and sales tax id are crucial steps for legitimizing your woodworking business in the eyes of the irs, vendors, and customers. Thankfully, there are several ways beginners can build a strong portfolio. The online ein application streamlines this required process. This can be tricky if artisans have just started and don’t have anything to show them. Woodworking Business Taxes.

From info.lagunatools.com

How to Scale Your Woodworking Hobby into a Small Business Woodworking Business Taxes learn how to plan, research and launch your own woodworking business with this comprehensive guide. Thankfully, there are several ways beginners can build a strong portfolio. You can choose from different. The first thing new clients will want to see is evidence that business owners do good work. Find out what projects to make and sell, how to calculate. Woodworking Business Taxes.

From www.youtube.com

How to Sell Woodworking Projects and Woodworking Business Tips YouTube Woodworking Business Taxes learn how to plan, research and launch your own woodworking business with this comprehensive guide. You can choose from different. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. build a professional portfolio. The first thing new clients will want to see is evidence that business owners do. Woodworking Business Taxes.

From www.pinterest.com

Starting a Woodworking Business with Wood Profits (With images Woodworking Business Taxes The online ein application streamlines this required process. learn how to plan, research and launch your own woodworking business with this comprehensive guide. registering your woodworking business is crucial for tax purposes and legal protection. This can be tricky if artisans have just started and don’t have anything to show them yet. setting up a separate business. Woodworking Business Taxes.

From www.youtube.com

5 Proven Tips for StressFree Woodworking Business Tax Prep YouTube Woodworking Business Taxes Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers. You can choose from different. The online ein application streamlines this required process. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. The first thing new clients will want. Woodworking Business Taxes.

From www.youtube.com

How to Start a 30K/Month Woodworking Business YouTube Woodworking Business Taxes build a professional portfolio. This can be tricky if artisans have just started and don’t have anything to show them yet. You can choose from different. Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers. Thankfully, there are several ways beginners can build a strong portfolio. The. Woodworking Business Taxes.

From www.youtube.com

Top 10 Profitable Woodworking Business Ideas YouTube Woodworking Business Taxes Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers. The online ein application streamlines this required process. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. The first thing new clients will want to see is evidence that. Woodworking Business Taxes.

From www.youtube.com

Our Tax Strategy Woodworking Business Side Hustle YouTube Woodworking Business Taxes You can choose from different. Find out what projects to make and sell, how to calculate costs and profits, and where to get supplies and customers. build a professional portfolio. The online ein application streamlines this required process. The first thing new clients will want to see is evidence that business owners do good work. This can be tricky. Woodworking Business Taxes.

From how-to-start-a-woodworking-business.s3.amazonaws.com

How to Start a Woodworking Business Woodworking Business Taxes You can choose from different. The first thing new clients will want to see is evidence that business owners do good work. setting up a separate business bank account simplifies accounting, aids in tax preparation, and lends credibility to your. The online ein application streamlines this required process. obtaining an ein and sales tax id are crucial steps. Woodworking Business Taxes.